Overview

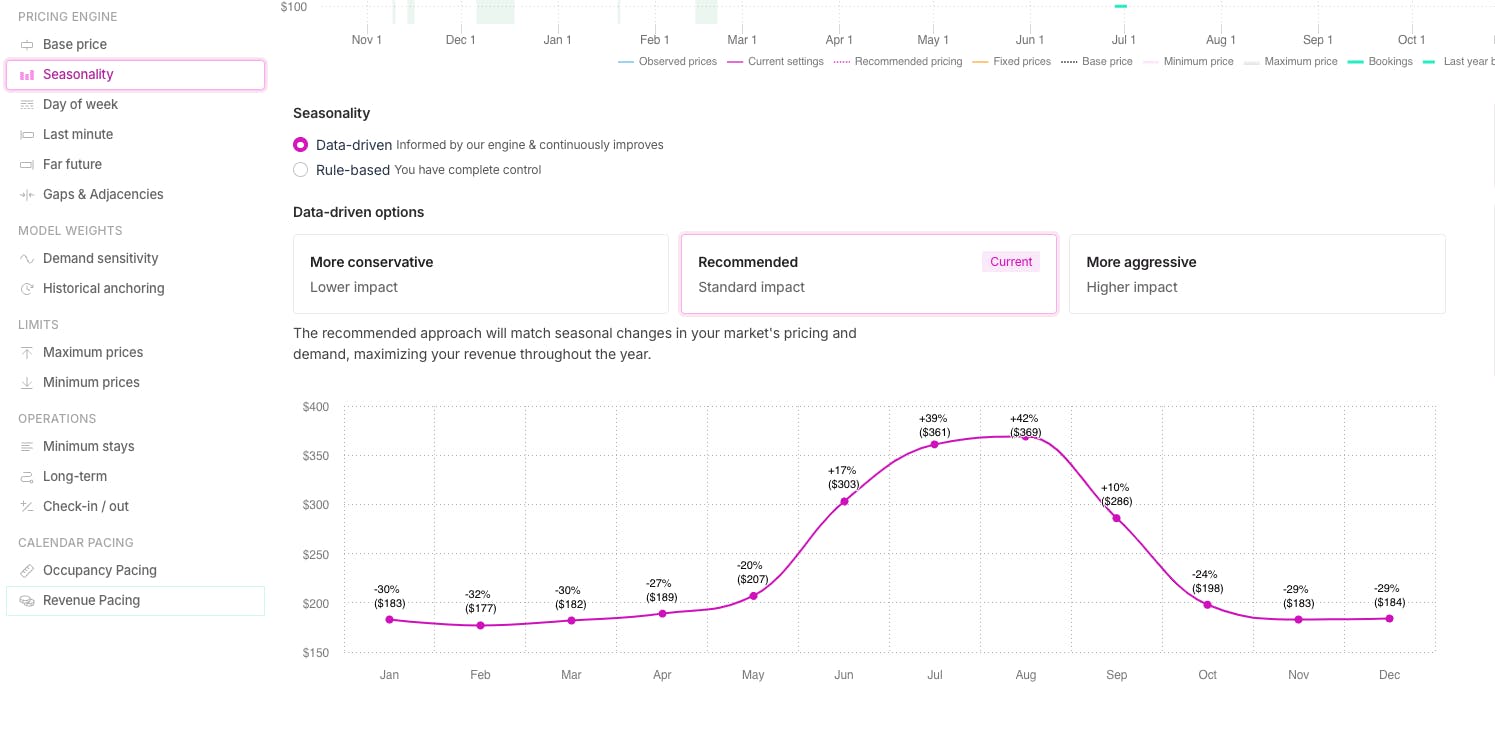

When predicting upcoming demand for a market, Wheelhouse has long aimed to isolate each market’s ‘Seasonality Curve’. This curve is one of the demand patterns we seek to understand, in order to help you better price your listings (other demand patterns include Day of Week, Local Events, etc)

In general, “Seasonality” refers to a broad, slow-moving demand curve that is both relatively predictable and repeats annually. For example, a summer “High Season” will often impact ALL listings in a market, every year, and in a relatively consistent manner. Predicting this demand curve accurately is a far different data science approach relative to detecting and responding to local events, which may impact fewer listings, infrequently, with less certain final booking outcomes.

For many years, Wheelhouse’s Seasonal Demand Curve for a listing has been calculated on a market level.

The benefit of this approach is that listings can “learn” from all the observed data/booking patterns in an entire market, to generate an informed seasonal demand curve.

The drawback of this approach occurred for markets that clearly contained multiple, distinct seasonality curves.

For example, Wheelhouse serves markets that feature both a ski mountain and a popular lake front. In those markets, we’ve long observed highly differentiated booking patterns. To paraphrase our customers in these markets, “Our listings book from the mountain down in the winter, and the lake up in the summer.”

18 months in the making, we began research on various approaches that could create a listing-specific seasonality curve.

Our goal was to create a seasonality curve that was much more listing-specific, while not removing too much of the signal we can derive from nearby listings.